What is an AdWords Intelligence Solution?

In today’s hyper-competitive digital landscape, running ads without understanding what your competitors are doing is like playing chess blindfolded. Every advertising dollar counts, and the difference between a winning campaign and wasted spend often comes down to one critical factor: intelligence.

An ad intelligence solution transforms how businesses approach digital advertising by turning competitor data into your strategic advantage. Whether you’re managing Google Ads campaigns, marketplace advertising, or multi-channel media investments, understanding ad intelligence is no longer optional—it’s essential for survival and growth.

What is an Ad Intelligence Solution?

An ad intelligence solution is a sophisticated platform that automatically collects, analyzes, and structures competitor advertising data across digital channels to inform and optimize your own marketing strategy. Think of it as your competitive surveillance system that operates 24/7, revealing exactly where your competitors are spending their budgets, which audiences they’re targeting, what creative approaches they’re testing, and how their campaigns evolve over time.

The fundamental problem these solutions solve is data fragmentation. In the traditional approach, one platform might show spend estimates, another displays creative assets, and yet another reveals targeting parameters—all with outdated information scattered across multiple sources. Ad intelligence consolidates this chaos into actionable insights delivered in real time.

The Core Components

Every robust ad intelligence solution combines three essential layers:

Data Collection: Continuous monitoring across search engines, social platforms, display networks, video channels, and marketplace environments through web crawlers, API integrations, and proprietary tracking technologies.

Data Processing: Organizing raw advertising signals into structured datasets with metadata about spend, impressions, creative formats, targeting parameters, and performance indicators.

AI-Driven Analysis: Machine learning algorithms that identify patterns, detect strategic shifts, estimate budget allocations, and surface insights invisible to manual monitoring.

The result is a unified view of the competitive advertising landscape that replaces guesswork with data-driven decision-making.

Why Ad Intelligence Matters?

Understanding competitor advertising behavior delivers tangible benefits that directly impact your bottom line. Here’s what ad intelligence enables:

Gain a Competitive Edge

Detailed intelligence on budget allocation, campaign timing, and audience segmentation allows you to expect competitive pushes before they happen. When you know a competitor is ramping up spend in Q4 or testing new geographic markets, you can position your campaigns to either compete directly or exploit gaps in their strategy.

Optimize Ad Spend for Higher ROI

Spend estimates and performance benchmarks reveal which channels and formats deliver the strongest returns in your category. Instead of spreading budgets thin across every available platform, you can concentrate investments where the data proves results happen. This means avoiding platforms with declining impact and doubling down on high-yield opportunities.

Discover Market Opportunities

Monitoring competitor activity surfaces high-performing keywords with low auction pressure, geographic regions where competitors maintain minimal presence, and emerging audience segments they haven’t engaged. These gaps represent openings for faster growth with less competitive friction.

Improve Campaign Creative and Messaging

Access to competitor creative libraries shows which narratives, calls-to-action, and formats are being tested and scaled. This intelligence helps you refine messaging, avoid oversaturated themes, and maintain creative relevance as market trends evolve. When you see competitors consistently scaling video campaigns with specific themes, you gain validated insights about what resonates with your shared audience.

Understanding AdWords Intelligence?

Adwords Intelligence represents a specific subset of ad intelligence focused on Google’s advertising ecosystem. As Google has integrated artificial intelligence and machine learning into every aspect of Google Ads, understanding Adwords Intelligence has become critical for any business investing in search, display, shopping, or video advertising.

What is Adwords Intelligence?

Adwords Intelligence refers to the suite of AI-driven features and automation capabilities built directly into Google Ads. These systems use machine learning to automate and optimize campaign management across targeting, bidding, creative assembly, and performance optimization. Rather than relying on manual setups and constant adjustments, Adwords Intelligence enables campaigns to evolve dynamically based on real-time data signals and predictive modeling.

Core AdWords Intelligence Features

Smart Bidding: Automated bidding strategies that analyze millions of data points—device type, location, time of day, user intent, browsing history—to set optimal bids for each auction. Strategies like Target CPA, Target ROAS, and Maximize Conversions eliminate manual bidding errors and continuously optimize toward your business objectives.

Performance Max Campaigns: Google’s most advanced campaign type that leverages AI to manage ad placements across Search, Display, YouTube, Gmail, Discover, and Maps from a single campaign. Performance Max uses your conversion goals and asset inputs to automatically allocate budget to the highest-performing channels and audiences.

Responsive Search Ads (RSA): Instead of creating static ads, you provide multiple headlines and descriptions. Google’s AI dynamically tests combinations to identify which messaging resonates best with different audience segments. This continuous optimization improves click-through rates and conversion performance over time.

Audience Targeting with AI: Machine learning analyzes user behavior patterns to build and expand audience segments automatically. Custom audiences based on keywords and URLs combine with Similar Audiences and In-Market segments to reach high-intent users at the optimal moment in their purchase journey.

Conversational Experience: A natural language interface that guides campaign creation by analyzing your landing page and automatically generating headlines, keywords, and ad copy suggestions. This conversational AI reduces the technical barrier to launching effective campaigns.

Automated Asset Creation: AI-powered systems that generate ad creatives, including text-to-image capabilities for display campaigns. These tools analyze your website content and product feeds to produce relevant visuals and copy that align with your brand.

Why Adwords Intelligence Matters for Your Business

The shift toward AI-driven advertising represents a fundamental change in how Google Ads campaigns perform. Businesses leveraging Adwords Intelligence features typically see 15-30% improvements in conversion rates and significant reductions in cost per acquisition compared to manual campaign management.

The learning phase is critical—Google’s AI systems require approximately 1-2 weeks and at least 30-50 conversions to optimize effectively. During this period, campaigns gather data about which audiences, placements, and creative combinations drive results. Patience during this learning phase pays dividends as the system becomes increasingly efficient.

Marketplace Advertising Intelligence: Winning on Amazon and Beyond

While search and social advertising dominate much of the conversation around ad intelligence, marketplace advertising intelligence represents one of the fastest-growing and most competitive advertising environments. Platforms like Amazon, Walmart, Target, and specialized marketplaces have become critical battlegrounds for retail brands.

What Makes Marketplace Advertising Different

Marketplace advertising operates with unique dynamics that distinguish it from traditional digital advertising:

High Purchase Intent: Users on marketplace platforms are actively shopping, not browsing content. This means conversion rates typically exceed other channels, but competition for visibility is intense.

Product-Level Competition: Unlike search ads where you compete for keywords, marketplace advertising involves competing for specific product category placements and sponsored listing positions.

Algorithm-Driven Visibility: Marketplace algorithms determine product ranking based on multiple factors, including relevance, conversion history, seller performance, and ad spend. Understanding these algorithms is crucial for success.

Essential Marketplace Advertising Intelligence Capabilities

Sponsored Product Tracking: Monitor which competitors are running sponsored product ads, track their positioning in search results and product detail pages, and understand their promotional strategies.

Category Visibility Analysis: Identify which products dominate specific categories, analyze share of voice by brand, and discover opportunities in underserved subcategories.

Pricing and Promotion Intelligence: Track competitor pricing strategies, promotional calendars, and discount patterns to inform your own pricing decisions and promotional timing.

Keyword and Search Term Insights: Understand which search terms drive traffic in your category, identify keyword gaps where you can gain an advantage, and optimize product listings for maximum organic and paid visibility.

Performance Benchmarking: Compare your advertising metrics—click-through rates, conversion rates, advertising cost of sales (ACoS)—against category benchmarks to identify improvement opportunities.

Marketplace Intelligence Platforms

Several specialized platforms focus specifically on marketplace advertising intelligence:

For Amazon: Tools like Jungle Scout, Helium 10, and Perpetua provide comprehensive competitive intelligence, including keyword tracking, product launch detection, and advertising spend estimates specifically for Amazon’s ecosystem.

For Multi-Marketplace Intelligence: Platforms like CommerceIQ and Pacvue offer cross-marketplace visibility spanning Amazon, Walmart, Target, and other retail media networks, enabling a unified strategy across multiple platforms.

How Ad Intelligence Solutions Work

Understanding the mechanics behind ad intelligence platforms helps you evaluate which solution fits your needs and how to maximize the value you extract from these tools.

Data Collection Methods

Ad intelligence platforms employ multiple collection strategies to ensure comprehensive coverage:

Web Crawlers: Automated systems that scan publisher websites, mobile apps, and digital properties to capture display ads, native ads, and other visual advertising formats as they appear in the wild.

Platform API Integrations: Direct connections to advertising platforms like Meta’s Ad Library, Google’s Transparency Center, and LinkedIn’s Ad Library provide structured access to creative assets, targeting parameters, and official disclosures.

Search Monitoring: Specialized tools that track keyword bidding activity, ad copy variations, and placement patterns across search engines by simulating searches from multiple locations and devices.

Mobile and App Tracking: Systems that capture in-app advertising, app store listings, and mobile-specific creative formats across iOS and Android environments.

Marketplace Monitoring: Dedicated tracking of sponsored product listings, sponsored display placements, and promotional activity within e-commerce marketplaces.

The Role of AI and Machine Learning

Artificial intelligence transforms raw advertising data into strategic intelligence through several sophisticated processes:

Creative Classification: Computer vision algorithms analyze visual elements to categorize ad formats, identify design patterns, and extract text from images and videos.

Spend Estimation: Machine learning models combine impression data, placement costs, geographic distribution, and industry benchmarks to estimate competitor advertising budgets with increasing accuracy.

Trend Detection: Algorithms identify pattern changes over time, flagging when competitors shift channel mix, adjust messaging themes, or modify targeting strategies.

Performance Prediction: Advanced models correlate observable advertising behaviors with likely performance outcomes, helping you predict which competitor strategies are working based on their subsequent actions.

Data Processing and Enrichment

Raw advertising signals undergo extensive processing to become actionable intelligence:

Metadata Tagging: Each captured ad receives structured tags for format type, messaging category, call-to-action style, promotional content, and creative direction.

Temporal Analysis: Ads are tracked over time to identify testing patterns, measure creative longevity, and understand campaign evolution cycles.

Cross-Channel Correlation: Systems link advertising activity across multiple platforms to build comprehensive views of integrated campaigns.

Competitive Benchmarking: Individual advertiser data is aggregated to create category-level benchmarks, share of voice metrics, and relative positioning insights.

Key Features of Advertising Intelligence Platforms

When evaluating ad intelligence solutions, focus on these core capabilities that deliver the most strategic value:

Competitive Visibility and Spend Estimation

Track active campaigns across channels, geographies, and formats with modeled spend estimates derived from impression volumes and placement costs. This capability enables accurate benchmarking against direct competitors and category leaders while providing visibility into budget allocation strategies.

Creative Intelligence and Analysis

Comprehensive creative libraries that capture competitor ads with full metadata—images, videos, ad copy, headlines, and calls-to-action. Advanced platforms include creative scoring systems that identify which elements correlate with engagement and performance.

Performance Benchmarking

Market share metrics, including impression volumes, share of voice, and spend distribution across competitors, establish baselines for competitive visibility. These benchmarks help you measure whether you’re gaining or losing ground relative to key competitors.

Audience and Targeting Insights

Detailed visibility into demographic, geographic, device-level, and psychographic targeting parameters that competitors employ. This intelligence reveals audience overlaps, highlights underserved segments, and exposes shifts in targeting strategy.

Channel-Specific Intelligence

Social Media Tracking: Monitor sponsored content across Meta platforms, TikTok, LinkedIn, Pinterest, and Twitter/X with engagement indicators and audience targeting attributes.

Search Advertising: Capture keyword bidding activity, ad copy variations, and extension usage across Google, Bing, and other search engines.

Display and Video: Track placements across publisher networks, programmatic exchanges, and premium properties with creative analysis and rotation frequency.

Connected TV (CTV): Monitor advertising presence across streaming platforms like Hulu, Roku, YouTube TV, and platform-specific services.

Marketplace Advertising: Detailed tracking of sponsored listings, brand advertising, and promotional activity within Amazon, Walmart, and specialized e-commerce marketplaces.

Integration and Data Export

API access, scheduled data exports, and direct integrations with business intelligence tools enable you to combine external competitive intelligence with internal performance data for unified analysis and reporting.

Building Your Ad Intelligence Strategy

Access to competitive data becomes valuable only when translated into deliberate action. Follow this structured approach to develop an intelligence-driven advertising strategy:

Step 1: Establish Your Baseline

Before analyzing competitors, document your current performance in detail. Break down spend by channel, campaign objective, audience segment, and creative format. Define the core KPIs you’ll use for competitive comparison—typically including cost per acquisition (CPA), return on ad spend (ROAS), share of voice (SOV), and impression share.

This internal benchmark provides the context needed to evaluate whether competitor strategies represent genuine opportunities or are actually less efficient than they appear.

Step 2: Identify Key Competitors

Select 3-5 direct competitors to analyze in depth based on market overlap, audience similarity, and strategic relevance. Include both established category leaders and emerging challengers. Consider analyzing 1-2 adjacent competitors from related categories who might provide creative inspiration or reveal untapped opportunities.

Step 3: Analyze Competitor Messaging and Creative

Catalog active creatives across platforms, tagging each by format, headline theme, call-to-action type, and offer structure. Pay special attention to how competitors frame value propositions—do they emphasize price, exclusivity, features, or emotional benefits?

Track this messaging over time to identify seasonal patterns, promotional cadences, and strategic pivots. Longitudinal analysis reveals not just current positioning but how competitors adapt as markets evolve.

Step 4: Map Channel and Audience Gaps

Construct a comprehensive channel map showing competitor activity levels across search, display, social, CTV/OTT, and marketplaces. Note where competitors concentrate investments versus where they maintain minimal presence.

Examine audience coverage thoroughly. Are competitors heavily invested in particular demographic segments while leaving others underserved? Do they dominate certain geographic markets while neglecting secondary regions?

These gaps often indicate low-priority segments, resource constraints, or strategic blind spots. Capturing share in overlooked areas can deliver efficient wins before competitors redirect budgets.

Step 5: Translate Insights into Action

Use competitor intelligence to inform both creative development and media buying decisions. When rivals consistently scale specific campaign types with apparent success, it validates market demand worth testing in your own mix.

Conversely, when competitors cluster around the same messaging themes, differentiate by emphasizing unique attributes or stronger customer outcomes. The goal is strategic positioning that stands out rather than following the herd.

Channel gaps, creative saturation, and message clustering should guide where you invest aggressively, where you test cautiously, and where you intentionally diverge to capture attention.

Step 6: Monitor, Iterate, and Refine

Competitive intelligence is perishable—ad spend shifts, creatives rotate, and targeting evolves within weeks. Establish a regular review cadence (weekly for tactical adjustments, monthly for strategic analysis) to refresh competitor data, update benchmarks, and validate the impact of your changes.

Treat each analysis cycle as an experiment: implement changes, track outcomes, and refine hypotheses. This continuous learning approach ensures your campaigns evolve in response to real market dynamics rather than assumptions.

Best Practices for Maximum ROI

Implementing these practices separates tactical monitoring from strategic advantage:

Focus on Patterns, Not Individual Ads

Resist dissecting every single competitor ad. Instead, analyze trends over time: shifts in channel allocation, evolution of creative themes, changes in audience targeting. Longitudinal insights reveal where competitors are placing future bets, which matters far more than reacting to isolated campaigns.

Combine Internal and External Data

Competitor signals provide only half the picture. Real leverage comes from correlating external intelligence with your own performance metrics. When a competitor increases spend on valuable keywords, monitor whether your click costs rise or performance declines. This combined view quantifies competitive pressure and informs budget reallocation.

Look Beyond Direct Competitors

Limiting analysis to your immediate category narrows the opportunity. Study adjacent industries and market leaders outside your space. Consumer brands pioneering creative formats on emerging platforms often provide insights adaptable to B2B contexts. Borrowing strategies from unexpected sources frequently spark differentiation.

Distribute Insights Cross-Functionally

Ad intelligence shouldn’t remain siloed within media buying teams. Competitive creative themes inform content strategy. Promotional patterns guide product marketing. Pricing intelligence supports sales conversations. Sharing insights broadly ensures competitive awareness permeates every customer touchpoint.

Establish Governance and Accountability

Set consistent review cycles and apply governance by assigning owners to insights, decisions, and outcomes. This prevents competitive monitoring from becoming noise without action and ensures findings drive measurable business impact.

Test Before Scaling

When competitor intelligence suggests promising opportunities, test hypothetically sound strategies in controlled environments before committing significant budgets. Competitors’ visible success doesn’t always translate to your unique business context, audience composition, or brand positioning.

Maintain Ethical Boundaries

Use ad intelligence to inform strategy, not to copy competitor creative or engage in deceptive practices. Focus on understanding market dynamics, identifying opportunities, and developing differentiated positioning rather than replicating what others do.

Common Mistakes to Avoid

Even sophisticated ad intelligence platforms can’t prevent these strategic errors:

Reacting Too Quickly to Competitor Moves

Seeing a competitor launch a new campaign doesn’t mean you should immediately respond. They might be testing, making mistakes, or pursuing objectives different from yours. Distinguish signal from noise by watching for sustained patterns rather than knee-jerk reactions to tactical experiments.

Copying Without Understanding Context

What works for a competitor with different brand equity, customer relationships, pricing structures, or operational capabilities may fail in your context. Use intelligence to inform hypothesis development, not to clone strategies without critical evaluation.

Ignoring Your Own Data

External competitive intelligence loses value when disconnected from internal performance reality. A competitor might dominate a channel that produces poor ROI for your specific business model. Trust validated internal data over external observations when conflicts arise.

Analysis Paralysis

Competitive intelligence can overwhelm decision-making when you track too many competitors, monitor too many metrics, or constantly seek perfect information before acting. Establish focus areas, define decision triggers, and maintain bias toward action informed by intelligence rather than paralyzed by data volume.

Neglecting Emerging Competitors

Mature businesses often focus on established rivals while missing disruptive competitors gaining momentum. Periodically audit your competitive set to identify new entrants, particularly direct-to-consumer brands and digitally-native companies that leverage novel advertising approaches.

Forgetting the Customer

In pursuit of competitive advantage, don’t lose sight of customer needs, preferences, and behaviors. The most sophisticated competitive strategy fails if it doesn’t ultimately deliver superior value to the humans making purchase decisions.

The Future of Ad Intelligence

Several emerging trends are reshaping how businesses leverage advertising intelligence:

Predictive Intelligence

Next-generation platforms are moving beyond descriptive analytics (what happened) toward predictive intelligence (what will happen). Machine learning models trained on historical campaign data increasingly forecast competitor moves before they occur, enabling proactive rather than reactive strategy.

Privacy-First Intelligence

As privacy regulations expand and platform transparency evolves, ad intelligence solutions are developing new methodologies that respect user privacy while maintaining competitive visibility. Expect greater emphasis on aggregated insights, panel-based measurement, and first-party data integration.

Real-Time Optimization

The gap between competitive intelligence gathering and strategic action continues to compress. Advanced platforms now offer real-time alerts when competitors shift strategies, coupled with automated recommendations for immediate tactical responses.

Cross-Channel Attribution

Understanding how competitor campaigns interact across channels—how search ads support social engagement, how display builds awareness that converts in marketplaces—represents the next frontier. Platforms that successfully map these connections will deliver significantly deeper strategic intelligence.

AI-Generated Competitive Insights

As large language models and generative AI evolve, expect platforms that not only present competitive data but automatically generate strategic recommendations, draft campaign responses, and simulate outcome scenarios based on competitor intelligence.

READ ALSO:- What is Performance Marketing?

Conclusion: Intelligence as Competitive Advantage

In digital advertising, information asymmetry creates opportunity. When you understand competitor strategies, market trends, and audience behaviors better than rivals, you make smarter decisions about budget allocation, creative development, and strategic positioning.

Ad intelligence solutions—spanning general advertising intelligence platforms, specialized Adwords Intelligence capabilities, and focused marketplace advertising intelligence—transform this information advantage from aspiration to operational reality.

Success requires more than access to data. It demands structured processes for analysis, clear frameworks for translating insights into action, and organizational commitment to intelligence-driven decision making.

Whether you’re managing Google Ads campaigns, competing in marketplace environments, or orchestrating multi-channel advertising strategies, investing in robust ad intelligence capabilities and building the operational discipline to leverage them effectively represents one of the highest-ROI decisions you can make.

Related Articles

Continue your learning journey with these related insights

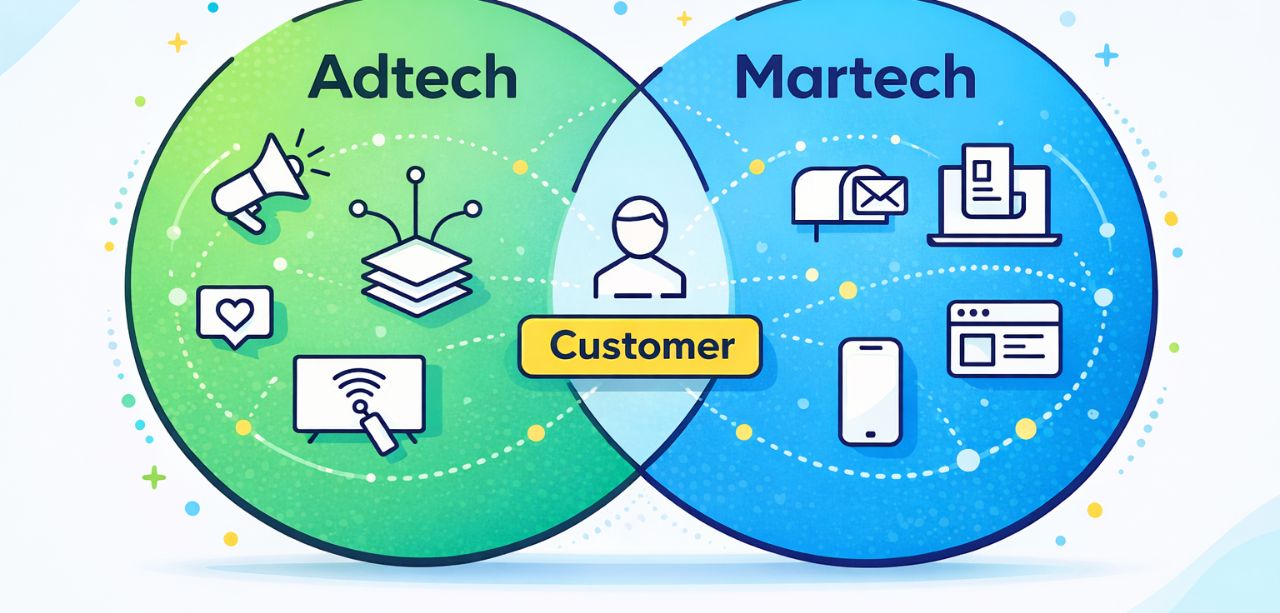

What’s the Difference Between AdTech and MarTech?

In today’s digital-first world, marketing success depends heavily on technology. Two terms you’ll hear constantly are MarTech and AdTech. While they often work together, they serve very different purposes. Understanding the differences between martech and adtech is essential for building effective marketing strategies, enhancing customer experience, and maximizing return on investment (ROI). This guide explains […]

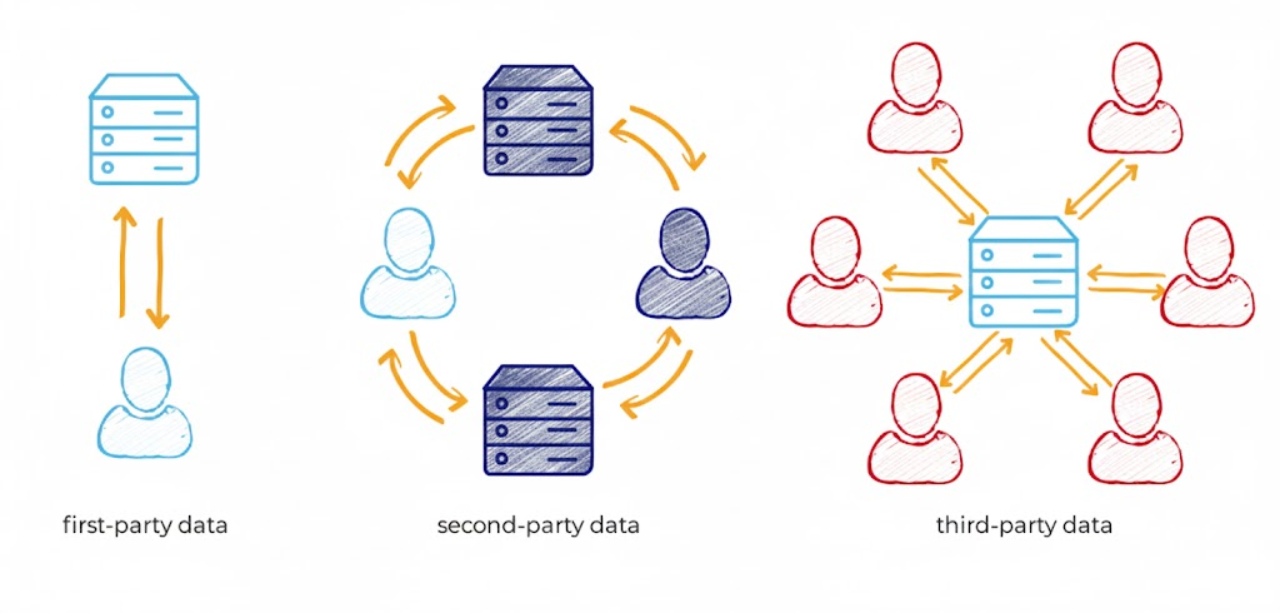

Everything You Need to Know About First-Party Data

In today’s privacy-first digital landscape, understanding first-party data has become crucial for businesses seeking to establish meaningful customer relationships while complying with evolving regulations. First-party data is information that companies collect directly from their customers through their own channels, making it the most valuable and reliable data source available to modern marketers. As third-party cookies […]

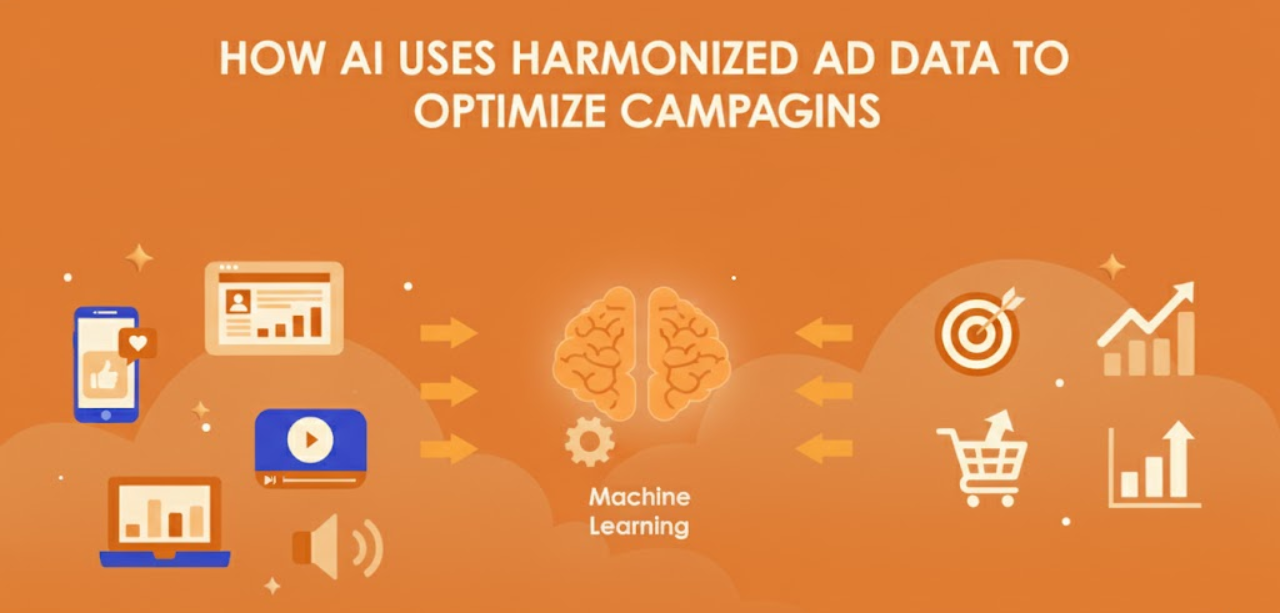

How AI Uses Harmonized Ad Data to Optimize Campaigns

Digital advertising wastes billions every year. Poor timing, wrong audiences, and scattered data are the main problems. AI fixes this by combining data from all your platforms into one smart system that actually works. What Is Harmonized Ad Data? Harmonized ad data means combining information from all your advertising platforms into one place. Instead of […]

Ready to Transform Your Advertising Strategy?

Join thousands of advertisers who trust Performoo to optimize their campaigns and maximize revenue.